Tax calculations are one of those things that seem simple until they go wrong.

A small mistake in tax rates, locations, or rounding can lead to undercharging customers, overcharging them, or spending hours fixing orders after the fact. For online stores and service sites, that quickly turns into lost trust and extra support work.

This is where many WordPress sites struggle. Some tax calculator plugins are too basic, while others are so complicated that they create more problems than they solve.

I tested a wide range of WordPress tax calculator plugins in a demo environment, from simple rate calculators to advanced tools that automatically handle multiple tax regions. The differences in accuracy, setup time, and long-term usability were hard to ignore.

In this guide, I’ll share the best WordPress tax calculator plugins to help you handle taxes correctly without adding unnecessary complexity to your site.

My Verdict: The Best WordPress Tax Calculator Plugins

If you are in a hurry, then just take a quick look at my expert picks to make a decision:

| # | Plugin | Best For | Pricing |

|---|---|---|---|

| 🥇 | WPForms | All-in-one tax calculator solution | $49.50/yr + Free |

| 🥈 | Formidable Forms | Complex tax calculator forms | $39.50/yr + Free |

| 🥉 | Easy Digital Downloads | Adding tax cost fields for digital products | $99.50/yr + Free |

| 4 | WooCommerce Shipping And Tax | Adding shipping and tax cost fields in WooCommerce | Free |

| 5 | WP Simple Pay | Adding tax collection field in payment forms | $49.50/yr + Free |

| 6 | TaxJar | Streamlining tax compliance for businesses | $205/yr |

| 7 | Stylish Cost Calculator | Free cost and tax estimation calculators | Free |

What to Look for in a WordPress Tax Tool

Keep in mind that “tax plugin” can mean something completely different for each use case. The right tool depends on your specific needs. This guide covers three main types of tools:

- Interactive Tax Calculators: These plugins let you create forms where visitors can calculate tax amounts themselves. They are great for providing quotes, creating mortgage calculators, or offering a helpful tool to engage your audience.

- Automated eCommerce Tax: These tools work with platforms like WooCommerce or Easy Digital Downloads. They automatically add the correct sales tax at checkout based on a customer’s location. This is essential for any online store.

- Tax Compliance Services: These are complete software platforms that handle everything from real-time calculations to filing tax returns. They connect to your store via a WordPress plugin, but are much more comprehensive.

Understanding these differences will help you choose the best solution from my list below.

How I Tested And Reviewed Tax Calculator Plugins For WordPress

If you have an online store, then tax calculator plugins can automate sales tax calculations for each transaction and streamline the purchase process.

These tools also ensure accurate calculations, reducing the risk of overcharging or undercharging customers. Plus, they typically comply with tax regulation laws.

Several of our partner brands use the built-in tax calculation feature from Easy Digital Downloads when selling plugins across their websites. But I also wanted to look for other options to fit your needs.

To help you find the ideal tool for your website, I tested popular tax calculator plugins and paid attention to the following criteria:

- Ease of Use: I have included beginner-friendly plugins that do not require you to know coding or tax regulation rules for every country.

- Features: In my opinion, the ideal tax calculator plugin should have features like automated tax calculations, real-time tax rate updates, tax geolocation, compliance updates, and more.

- Performance Impact: I monitored the tax plugin’s effect on website speed and performance, ensuring it works smoothly even on high-traffic sites without affecting the user experience.

- Security: I assessed each tool’s security measures, ensuring they protect sensitive financial data and maintain compliance with necessary regulations.

- User Feedback: I considered actual user feedback and ratings to understand common experiences, strengths, and challenges faced by those who have used these plugins.

- Reliability: I have only recommended the plugins that I have tested on real websites. I also went through customer reviews.

🤝 Why Trust WPBeginner?

At WPBeginner, we’re not just WordPress experts — we also run multiple online businesses ourselves. But we didn’t start out big.

Just like many small business owners, we had to figure things out from scratch, including how to handle taxes. That experience helped us understand exactly what beginners need when looking for an easy and reliable tax plugin.

We’ve tested countless tax tools across our websites to find the ones that actually work well, without slowing down your site or causing technical issues.

Our goal is to help you find the right solution faster, so you can focus more on growing your business and less on handling complex tax rules. For details, see our editorial process.

Having said that, let’s take a look at the best tax calculator plugins for WordPress.

1. WPForms (Tax Calculator Forms)

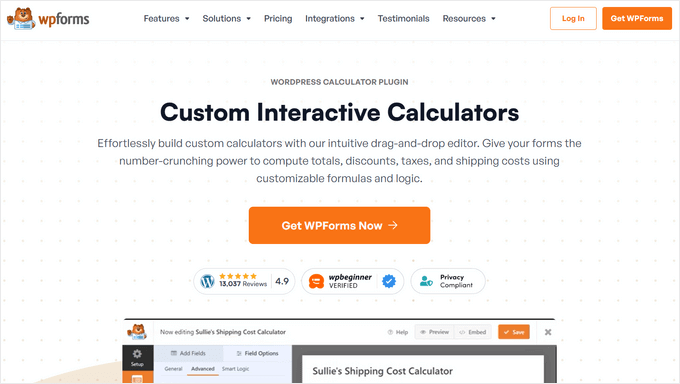

WPForms is the best online form builder with a Calculations add-on, which you can use to build a powerful tax calculator form. This makes it ideal for all kinds of online businesses, especially eCommerce stores.

At WPBeginner, we’ve used WPForms to create contact forms and surveys, and it has consistently delivered great results.

Its user-friendly interface and extensive collection of pre-made templates make it easy for me to create secure, visually appealing forms in just a few minutes.

To learn more about our experience, check out our WPForms review.

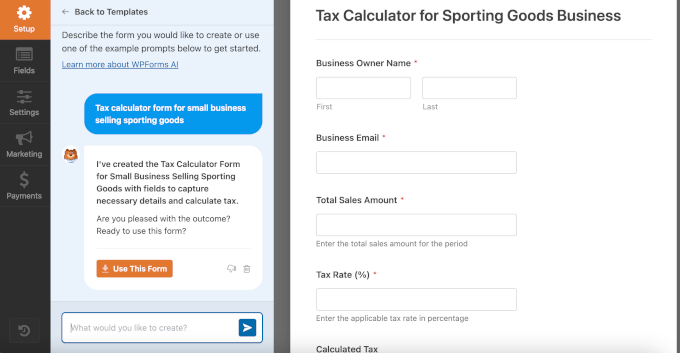

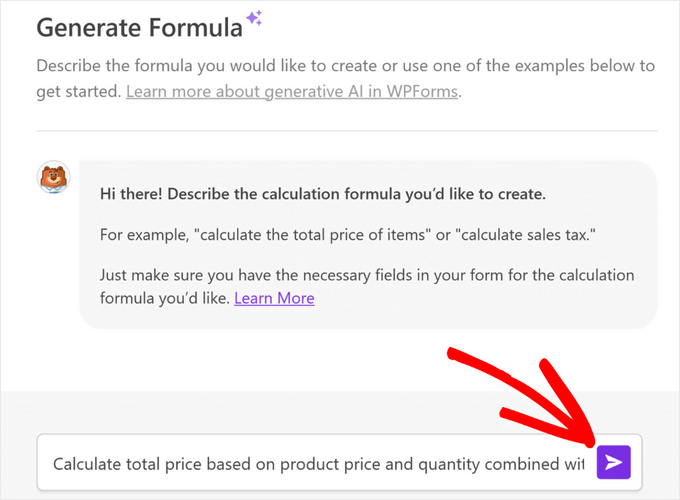

Apart from premade templates, you can use WPForms AI to generate a custom form that fits your specific needs. Simply type in the type of tax calculator you need, hit the arrow button, and you’ll have a usable form in seconds.

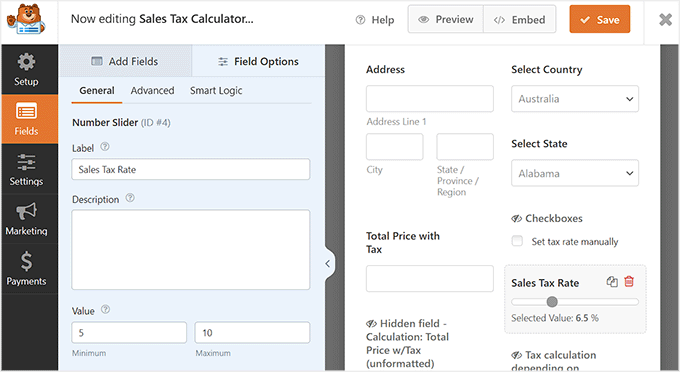

WPForms allows for conditional logic within forms, letting you apply different tax rates based on user input, such as zip code or state selection.

You can also use WPForms’ built-in features to create a formula that calculates the tax amount based on the subtotal and the chosen tax rate.

If math isn’t your strong suit, don’t worry. WPForms’ AI Calculations feature can handle advanced formulas for you.

All you need to do is describe what you want to calculate in plain English and WPForms will generate the correct formula instantly. No mathematical expertise required.

Creating a tax calculator form with WPForms can also be a part of your lead generation strategy. It lets you provide interactive content that engages visitors and encourages them to share their contact information in exchange for a useful service.

This not only drives more traffic to your site but also helps you capture potential leads who are interested in products or services related to finance and taxation.

For details, see our tutorial on how to get more leads with free online calculators.

WPForms also offers other powerful features, such as integrations with email marketing services, file uploads, surveys and polls, Stripe integration, coupons, conversational forms, and more.

✅ Pros of WPForms

- It has pre-built functions for calculating averages, rounded numbers, random numbers, and time ranges.

- Supports advanced calculators like mortgage, shipping discount, and BMI calculator.

- Allows full customization of form styles, including colors, fonts, and labels.

- Includes over 2,000 premade templates and built-in spam protection.

- Supports payment collection through PayPal and Stripe.

- Integrates seamlessly with popular email marketing services.

❌ Cons of WPForms

- The free plan does not include the Calculations addon. You need a pro version.

Why I recommend WPForms: Overall, WPForms is the best tax calculator plugin on the market because it offers a beginner-friendly visual builder, premade calculator templates, and conditional logic. It also allows you to create your own formula for tax calculations.

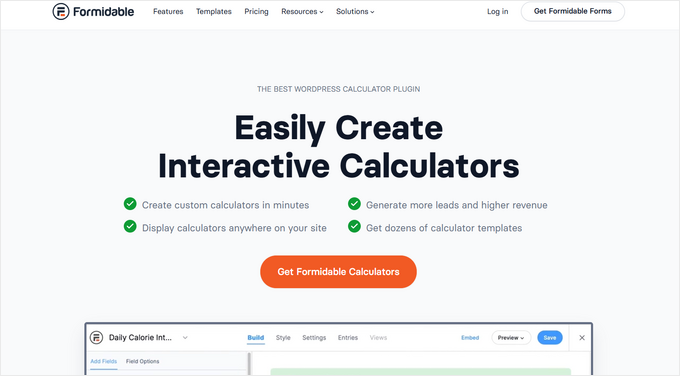

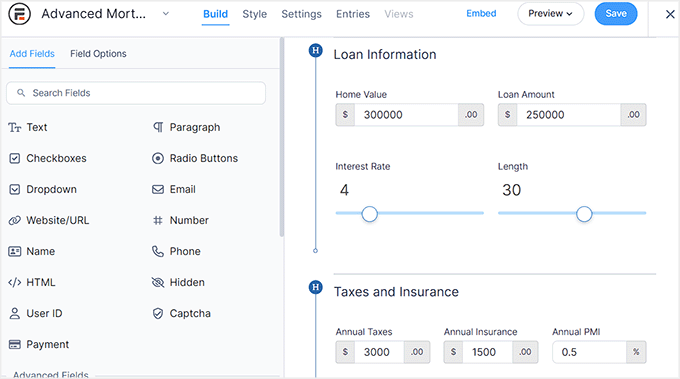

2. Formidable Forms (Complex and Dynamic Calculations)

Formidable Forms is an advanced form builder that allows you to create complex sales and income tax calculators in just a few minutes.

Although it has a steeper learning curve than WPForms, it does have advanced conditional logic and other developer-friendly features if you need a more complex calculator.

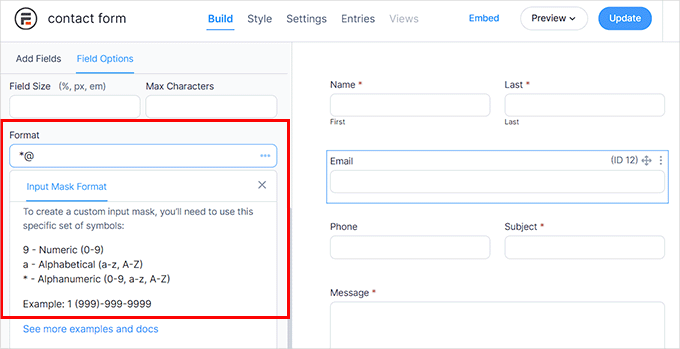

During my evaluation, I discovered that it also allows you to validate user data for any form field by choosing a specific format, protecting your site from spam entries.

For more information about the plugin feature, take a look at our Formidable Forms review.

Additionally, you can create other calculators like mortgage calculators, tip calculators, paycheck calculators, and more.

The plugin also lets users upload documents like pay stubs or W-2 forms directly through the form.

This can be helpful for applications requiring income verification for tax purposes.

Once that is done, Formidable Forms helps you manage and organize tax-related data and export submissions for analysis or record-keeping.

✅ Pros of Formidable Forms

- Integrates with multiple third-party tools and includes an API for custom connections.

- Includes a ‘Formula’ field for custom calculations such as taxes.

- Supports multi-currency formats with proper number styling.

- Allows use of dynamic text and progress bars for better user interaction.

- Can display submitted data in tables, listings, and graphs.

- Offers advanced features like conditional logic, file uploads, and multi-page forms.

❌ Cons of Formidable Forms

- Some templates are only available in the pro version.

- The wide range of features may feel overwhelming for beginners.

Why I recommend Formidable Forms: If you have a small business and need a complex income tax calculator with dynamic calculations, then Formidable Forms is the best plugin.

3. Easy Digital Downloads (Show Tax Rates for Digital Products)

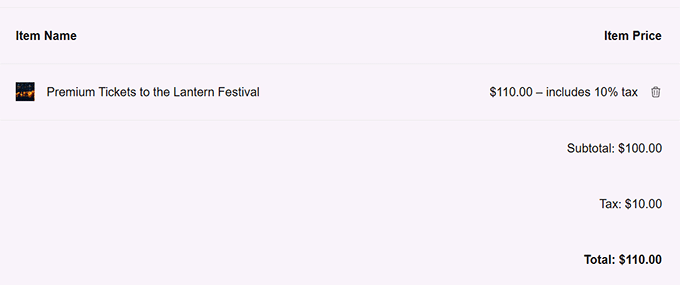

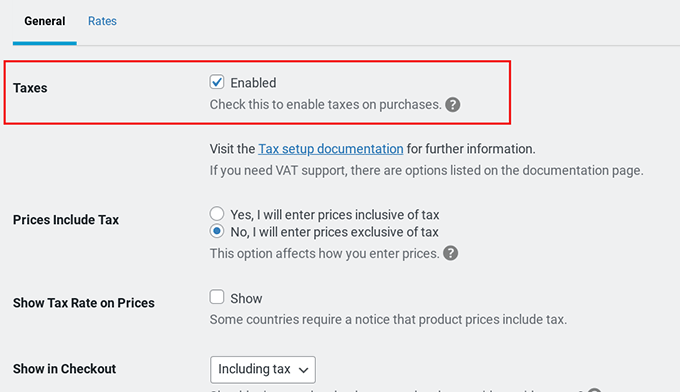

Easy Digital Downloads is the best eCommerce plugin for selling digital goods like music, PDFs, ebooks, and more. It also makes it super easy to collect tax from customers by automatically applying the correct rates at checkout.

Unlike an interactive calculator, EDD works in the background to add the right tax amount during a transaction. This streamlines the purchase process and ensures accuracy.

You can display these rates on the checkout page to inform users about the additional cost.

Several of our partner brands have been using EDD to sell plugins and software. They have shared with us that its tax collection features make it easy to display accurate tax amounts for customers, promoting transparency and trust during checkout.

For more details about its features, you can see our detailed Easy Digital Downloads review.

The plugin also allows you to add different tax rates for countries, provinces, and states, making it an ideal choice.

To get started, see our tutorial on how to collect taxes for Stripe payments in WordPress.

✅ Pros of Easy Digital Downloads

- Beginner-friendly interface for creating digital product stores.

- Generates detailed sales tax reports grouped by state, county, or other jurisdictions.

- Offers an EU VAT extension for compliance with European tax laws.

- Integrates with popular payment gateways like PayPal and Stripe.

- Allows passing payment processing fees directly to customers.

- Supports selling subscriptions.

❌ Cons of Easy Digital Downloads

- Many features beyond basic tax calculations require the pro version.

- Only displays tax amounts to customers and does not allow users to calculate taxes themselves.

Why I recommend Easy Digital Downloads: If you have an online store that sells digital products, then EDD is the best way to add a tax calculation field to your product prices.

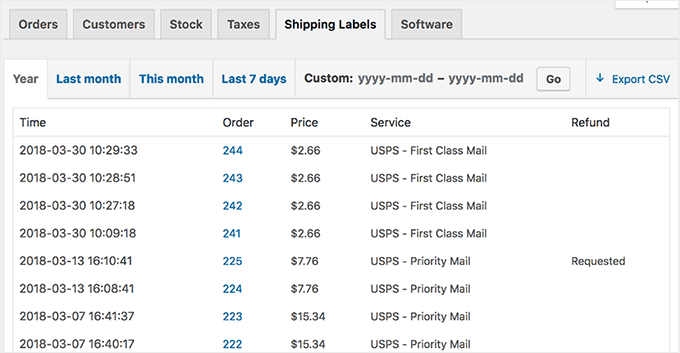

4. WooCommerce Shipping and Tax (Adding Tax Cost Field for Physical Products)

WooCommerce Shipping and Tax is a free WordPress plugin developed by the WooCommerce team. It helps you automatically calculate and apply the correct tax rates at checkout without needing to manually enter complex tax rules.

Instead of acting as an interactive calculator for visitors, this feature works in the background to ensure a seamless checkout experience by applying the correct taxes automatically.

During testing, I also tried integrating it with third-party tools for real-time tax rate updates, and it worked seamlessly. This ensures that your store stays compliant with the latest tax regulations, even if the rules change based on location or item type.

Another helpful feature is its integration with major shipping providers like USPS and DHL. This means your customers can see real-time shipping rates directly during checkout.

It adds transparency to your pricing and builds trust by giving shoppers a clear picture of their total cost before they place an order.

Overall, it’s a great all-in-one tool for small businesses looking for simple and automated solutions for both taxes and shipping.

✅ Pros of WooCommerce Shipping and Tax

- Includes geolocation features to display accurate tax and shipping rates based on customer location.

- Supports custom package sizes and weights for precise shipping cost calculations.

- Integrates seamlessly with WooCommerce and popular payment gateways.

- Offers an intuitive interface for configuring tax settings and shipping methods.

❌ Cons of WooCommerce Shipping and Tax

- Performs tax calculations automatically without displaying the calculation process to customers.

- Many advanced features, such as real-time tax rates and carrier-specific shipping options, require third-party integrations.

Why I recommend WooCommerce Shipping and Tax: If you are looking for a free way to add a tax and shipping cost field to your store’s checkout page, this is the WordPress tax plugin for you.

5. WP Simple Pay (Create Payment Forms With Tax Collection Field)

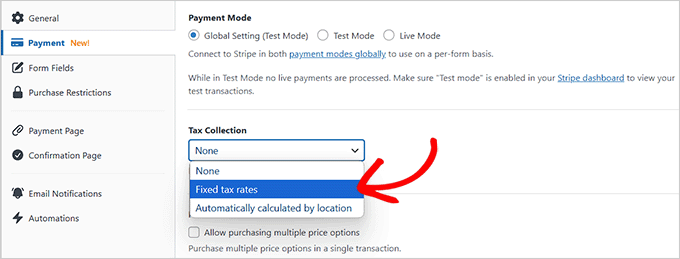

WP Simple Pay is the best WordPress Stripe plugin for adding all kinds of payment forms to your website. It also lets you collect taxes from customers using two methods.

In my extensive testing, I found this plugin super easy to use. It’s ideal for beginners selling subscriptions who want to show a tax calculation field at checkout. To learn more, see our WP Simple Pay review.

You can add a fixed rate tax calculation field and define the rate yourself. Once you do that, the field will calculate and display the tax amount to the customers filling out the form.

Additionally, you can enable the Stripe tax calculation feature, which automatically shows customers a tax amount based on their location.

For step-by-step instructions, see our tutorial on how to collect taxes for Stripe payments with WP Simple Pay.

✅ Pros of WP Simple Pay

- Allows you to choose whether taxes are added to the product price or displayed separately.

- Includes premade sales templates and supports gateways such as Klarna, Affirm, and SEPA.

- Stripe tax calculation can track when your business approaches tax registration thresholds in new jurisdictions.

- Supports deposit payments.

- Provides a built-in option to test Stripe payments easily.

❌ Cons of WP Simple Pay

- The free plan does not include Stripe tax collection, which requires a premium Stripe account.

- Not ideal for large online stores due to limited scalability features.

Why I recommend WP Simple Pay: If you sell services or just one specific product on your website, then I recommend WP Simple Pay for adding a payment form with a tax collection field.

6. TaxJar (Software for Filing Taxes)

TaxJar is a leading tax compliance service designed to streamline sales tax for businesses of all sizes. It’s a powerful SaaS platform that connects to your WordPress store via an integration plugin.

It is a complete solution for filing your taxes and generating reports.

I love that the service provides real-time sales tax rates based on customer locations, defines product taxability, and generates comprehensive sales tax reports by state, county, or even product category.

TaxJar can also automate tax filing and offers audit assistance services to help you navigate potential tax audits.

✅ Pros of TaxJar

- Integrates with WordPress and major eCommerce platforms using its API.

- Provides a user-friendly dashboard with insights into tax obligations across different jurisdictions.

- Offers responsive customer support for tax-related guidance.

- Automates tax calculations and filings to save time and reduce manual workload.

❌ Cons of TaxJar

- Does not offer a free plan.

- API setup may require technical knowledge or developer assistance.

Why I recommend TaxJar: If you are looking for a tool to help you file taxes, generate tax reports, and keep track of tax filing obligations, then TaxJar is for you.

7. Stylish Cost Calculator (Cost Estimation Calculators)

Stylish Cost Calculator is another free tax calculator plugin for WordPress that allows you to create visually appealing cost estimation calculators for your website.

It has a clean interface, offers multiple themes, and lets you add interactive elements like progress bars or color-coded fields to guide users through the calculation process.

Plus, I like its live input previews, which allow it to dynamically update estimated tax amounts as the user enters data.

✅ Pros of Stylish Cost Calculator

- Includes interactive tax brackets that visually show how tax rates change based on income levels.

- Mobile-friendly design for better accessibility.

- Integrates with payment gateways and supports conditional logic.

❌ Cons of Stylish Cost Calculator

- Best suited for simple cost calculations and may not support complex formulas.

- Offers limited integrations and may have compatibility issues with certain plugins.

Why I recommend Stylish Cost Calculator: If you want to add simple cost estimation forms with a field for tax, then this is the best choice for you.

What Is the Best Tax Calculator Plugin for WordPress?

In my opinion, WPForms is the best tax calculator plugin for WordPress because it comes with different editable templates for tax calculations.

You can choose from one of the pre-made tax calculator templates or even use its AI form builder to create a custom calculator.

Alternatively, if you have an eCommerce store that sells digital products, then you can use Easy Digital Downloads to add a tax collection field to the checkout page.

Similarly, if you have a store that sells physical products, then you can opt for WooCommerce Shipping and Tax.

On the other hand, if you just want tax calculations for a simple payment form, then WP Simple Pay is the ideal choice.

Frequently Asked Questions About WordPress Tax Calculator Plugins

Here are some questions that our readers frequently ask about tax calculator plugins for WordPress.

1. How do I automatically calculate tax in WooCommerce?

If you want tax to be automatically calculated for different products in your WooCommerce store, then you can use the WooCommerce Shipping and Tax plugin.

Upon activation, the plugin allows you to set a tax rate that will be used to collect taxes from customers based on the product prices.

2. Are there any free tax calculator plugins available?

There are multiple free tax calculator plugins, including WP Simple Pay. It lets you add a tax collection field to payment forms where you can set a fixed tax rate. Similarly, Easy Digital Downloads offers tax calculator fields in its free plan as well.

3. Do tax calculator plugins help with tax filing?

Most WordPress tax plugins do not help with filing and organizing your taxes. However, if you are looking for a solution like this, then you can go with TaxJar, which is a popular tax compliance software.

Related Guides for Tax Calculations in WordPress

- WordPress eCommerce Setup Guide for Beginners (7 Product Types)

- Best Calculator Plugins for Your WordPress Site

- How to Create a Custom Calculator in WordPress (Step by Step)

- Best WordPress PayPal Plugins for Easily Accepting Payments

- How to Collect Taxes for Stripe Payments in WordPress

- Best WordPress Ecommerce Plugins Compared

- How Much Do Ecommerce Websites Cost? (Real Numbers)

- How to Generate More Leads with Free Online Calculators (Pro Tips)

If you liked this article, then please subscribe to our YouTube Channel for WordPress video tutorials. You can also find us on Twitter and Facebook.

Have a question or suggestion? Please leave a comment to start the discussion.